What is NPV?

When you ask "What is NPV?", you must first realize that it is an acronym which stands for net present value. In broad terms net present value (NPV) is a way taking a set of cash flows and determining if they are economically favorable. Being economically favorable means that we want to know which ones will make us the most money or cost us the least. The net present value provides with a single number that summarizes the string of cash flows and provides an answer to it's value.

What is NPV? It Is About the Time Value of Money

To understand NPV we need to first understand the concept of time value of money. In simple terms the time value of money assumes that money that you have today is more valuable than money that you have some time in the future. The amount of difference in value is determined by the hurdle rate.

Here is an example:

If I have a savings account in which I deposit $100, and I receive annual interest of 3%, then I would have $103 at the end of one year. Now it would appear that since $103 is more than $100 that the future value of that savings account in one year would be more valuable than the present value today. The problem is that you don't have access to the $100 for one year. What is your sacrifice worth? Well, you have assigned a value of $3 to not being able to use your money for one year. You assigned that value by opening the savings account that pays you 3% interest. With that assignment you effectively made the value at the end of the first year equal to value at the start with a discount rate of 3%.

So the variables of our example are: Present Value (PV) = $100 Future Value (FV) = $103 Interest Rate (i) = 3% Years or Periods (n) = 1

Time Value of Money Calculator

So if we had a time value of money calculator, we could plug at least 3 of these variables into it to get the 4th. The TVM calculator is just a financial calculator. Many financial calculator apps are available for your smart phone. You may also have a hardware calculator that has financial functions. Finding present value with a financial calculator is easy. You simply enter 3 variables and then press the button for the 4th variable and you will have the missing variable. The one caveat is to play close attention to the + and - signs of your variables. So a calculator with financial functions is really a time value of money calculator. So you can find present value with a calculator. Also you can find future value with a calculator. You probably won't find a calculator able to find NPV.

Compound Interest

Now if we were to extend the above example to 2 years, we would get into the realm of compound interest. What is compound interest? It is simply the interest paid this year on the interest money received in previous years. So in our example, in year 2 we would receive $3 interest on the original $100 and $.09 interest on the $3 received in year 1. The $.09 is the compound interest. If we had a year 3, we would earn interest on the original $100 of $3 and on the accrued interest of $6.09 of $.19 for a total value of $109.27.

PV to NPV

We now need to find out how to calculate npv. First consider what the difference is between the term present value and net present value. The addition of the word net implies that there are several present values that need to be netted together. That indeed is the case.

Here is another example: Today -$1000 End of Year 1 200 End of Year 2 300 End of Year 3 600 End of Year 4 900 So for each year we have to find a present value. When we add up all of the present values we have the net present value. So the solution, using a 10% discount rate, is $495.

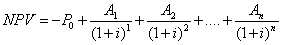

Net Present Value Formula

What is the net present value formula? The net present value formula is the mathematical equation required to calculate npv. The initial cost is normally negative. The future values can be either negative or positive. The future values are all brought back to the present by using the interest rate, discount rate or hurdle rate. The discount rate is modified by the number of years (periods) into the future. The equation's terms (0-n) represent each year or period. When all of these annual terms in the equation are added together you will have the net present value.

Discount Rate or Hurdle Rate

This is the trickiest part of calculating net present value. The discount rate chosen can change the results of the NPV comparison between sets of cash flows or projects. You can chose a rate that is equal to the prevailing interest rate. You can chose a rate that is the cost of capital for a business. Another choice might be a minimum acceptable rate of return. So if your project does not generate a return above the discount rate you will have a negative npv. A negative NPV tells you that the project is not feasible. This is why the discount rate is sometimes called the hurdle rate. The discount rate is the hurdle that your project must pass over in order to be a feasible project according to your criteria.

NPV Calculator

A net present value calculator is a software program that simplifies the calculation of net present value. The difference between a net present value calculator and a present value calculator is that the former calculates many present values at one time while the latter only calculates one. The NPV calculator on this website has an example column that provides guide for entering your own set of cash flows. One advantage of using a software NPV calculator is that you can quickly change the values of your cash flows to perform sensitivity analysis on the variables. The reason to do this is to see if changing your estimates of the future values would change the results of your NPV analysis. Another advantage is the ease versus using manual calculations. Without NPV Calculator software or a NPV Excel model, the manual method can be quite time consuming.

Try out the Cash Flow ForecastingWhat is cash flow forecasting? The values that we chose for our future cash flows in a net present value calculation are by nature estimates. We often can do a pretty good job of forecasting cash flows due to previous experience with similar situations. However, the reality of estimates is that they are not always correct. The more information that we can research about prices and costs of a particular project will increase the accuracy of our estimates and therefore the results of the net present value analyzes that we make with them. Sensitivity analysis is a way to gauge how sensitive the individual variables are to the final result. This subject is discussed elsewhere in this article.

The Project Life Cycle

What is the project life cycle? Different projects have different lives. The project life might depend on equipment wearing out or becoming obsolete. Erroneous results can result if you make a NPV comparison between projects with different lives. However, there is an approach that can adjust for those differences. If one project has a life of 10 years and another project has a life of 20 years, you can repeat the cash flows of the 10 year project so that the cash flows in comparison are both 20 years. With this creative solution to create equal lives, almost any project can be compared to another.

Capital Budgeting Process

A company that has multiple proposed projects wants to find the most profitable projects to use their limited capital on. So we can calculate NPV for each project. The ones that don't have a negative npv are the acceptable or feasible projects. All positive npv projects are then ranked with the highest positive ones first. Management must then decide if there are non quantitative reasons for accepting or rejecting the highest ranked projects. In other words they are looking for investing gold.

Possible Applications for Using NPV Analysis

Lease vs Buying Car

You just need to make two NPV calculations. For the lease you would find the annual cost and the upfront cost of taking possession of the your car. For buying you would take your down payment and the annual cost to calculate NPV. If the lease duration and the length of financing are different you must compensate as explained in The Project Life Cycle section above. The discount rate would be the financing interest rate.

Investment Feasibility

If you have a minimum annual return that you expect to receive on your investment, then don't accept a negative net present value. The minimum annual return expected will be your discount rate used by the NPV calculator. If you have many alternative investments then your task is similar to capital budgeting.

Lowest Cost Car or Equipment Over Its Lifetime

It is a mistake to just evaluate a car or equipment based on it's initial price. You should also consider, maintenance costs, fuel costs, speed of depreciation, etc. All of these factors can be quantified and included in the NPV calculation.

Summary

So, what is NPV? Because money is more valuable now than it is in a future time, it is necessary to summarize a series of annual cash flows by the sum of their net present values. This is done by bringing the value of each cash flow back to today by discounting it on the cost of money or the discount rate.

Questions From Readers

(All calculations will be performed using this site's NPV Calculator)

Question: A company is evaluating a new project which requires an initial investment of Rs 1,000,000 and would generate Rs125,000 per annum in perpetuity starting one year from now. Assume cost of capital as 10%. what is the NPV of the project?

Answer: A perpetual annuity is a special case of the PV formula that becomes very simple. The formula for perpetuities is:

So the NPV formula for this case becomes:

So the answer to the question is NPV=-1,000,000 + 125,000/.1 = 250,000

Question: If I have 20 lot sales a year for 15 years at a starting price of $200,000 what is the net present value of those sales in the first year?

Answer: To answer this question we need to have a discount rate. The answer will change depending on the discount rate chosen. For 10% the calculation gives $30,424,318 For 5% the calculation gives $41,518,632

Question: critically evaluate, appraise and analyze alternative sources of finance available to an organization. A firm has the opportunity cost of investing 1500 pound in a project with a life of three years. the estimated cash inflows are: 300, 1000 and 400 pounds for year 1, year 2 and year 3 respectively. the opportunity cost of capital is 10%. Calculate the net present value of the project's cash flow.

Answer: The NPV with a 10% discount rate is -100 pounds. The negative npv signals that the project is not a feasible one according to the criteria set forth. At a 5% hurdle rate the project has a net present value of 38 pounds. At the lower rate the project would be considered feasible.