NPV Calculator

"A NPV Calculator finds today's value for a project's lifetime of cash flows."

|

Why do you need a net present value calculator? The answer is for decision making. Let’s take the example of a real estate investor. She may have a choice of 3 different investments. With only enough money for one of them, which one does she choose? The obvious answer is to choose the one with the most profit. The NPV calculator is a method for deciding which of the alternatives is projected to make the most money. So, the simple answer is to choose the investment that has the highest net present value. You would simply put in the expected net return minus expenses for each year of the life of the investment with the discount rate for each of the investment alternatives. The biggest net number wins!

It also gives you your ROI or Return on Investment for a given project or investment. It is much more accurate than the payback method because it takes into account the buying power of money today versus the buying power in the future. The NPV calc uses discounted cash flow analysis to determine the present value of future cash flows. By using a project NPV calculator, investors can analyze the projected net return minus expenses for each year of the investment's life and apply a discount rate for each alternative to determine the investment's NPV. This calculation is crucial for determining which investment is projected to generate the most profit. NPV finance is an important concept and is used to evaluate the profitability of investment opportunities. The NPV analysis takes into account the time value of money. The use of an NPV calculator simplifies the analysis of multiple investment options by providing a clear comparison of the projected returns on investment. The NPV analysis can be used to evaluate single alternative investments or multiple investments to meet a specific requirement or regulation. How Does NPV Work?How does it do it? It takes all of the cash flows over the life of the investment and summarizes them into one number that represents that project’s value to the investor today. Analyzing the term net present value, it means the net or all the plus and minus cash flows brought back to the present and totaled to get the net value for the present time. This is done by using a process called discounted cash flow.

|

|

How do you discount a cash flow that is projected to occur in the future? You would use a discount rate or interest rate. The logic of this can be seen with the example of a savings account. If a $100 in a savings account earns 3% per year, then in one year your account would be $103 and in 2 years about $106. So, this tells you that if you were offered $100 in one year or $100 right now, your best choice would be $100 today because the $100 one year from now would be worth less that it be to day. This concept is called the time value of money.

Now you might choose to use this 3% discount rate, because it is the risk-free rate to you. However, to compensate for the increased risk of your prospective investment, you might want to add a few percentage points to include the risk-free rate as well as a risk premium. Now a corporation that borrows money to invest in projects internally might want to use a base rate of the average cost of capital.

Interpreting the Results

There are several types of situations where you might be making an analysis.

1. A single alternative. You would accept the investment if you have a positive NPV. (A positive NPV means that the rate of return is greater than the discount rate.)

2. Multiple profitable investments. You would choose the investment with the highest positive NPV.

3. Multiple investments to satisfy a requirement. If there are multiple alternatives that would meet a regulation or possibly a safety issue, then you want the investment with the lowest lifetime cost. The choice would be the alternative that has a negative NPV closest to zero.

Is the NPV Calculator the Best Financial Decision Maker?

The answer to this question is maybe. The IRR Calculator may give a clearer picture of an investment’s financial benefits. This is especially true when comparing projects with different lives. Although adjustments can be made to the NPV calculation to account for the unequal lives, the analysis is much more straight forward when using an IRR calculation. When you see the IRR results as a percentage return the value of an investment may be more intuitively obvious. However, the IRR may show unexpected results. Therefore, it is a good practice to evaluate an investment using both techniques.

Calculate Net Present Value

You can compute the net present value by utilizing the Excel NPV function, which involves setting up a spreadsheet to obtain the desired results. Alternatively, the cash flow process of the NPV calculator on this page is already configured for immediate use without requiring setup time.

The Net Present Value Calculator

You will see two series of cash flows. Each series of cash flows support the net present value results at the bottom. To obtain a NPV for your cash flows, you need to supply the actual cash flows from each project. You will also need to supply the discount rate. Be sure to clear out the numbers to zero for the years not needed. The year column can be changed by just changing the first year. Pay close attention to the numbers that you put into your analysis. You don't want the expression "Garbage in, garbage out." to apply to an analysis that you are using to make an important business decision.

Possible Applications

Possible Applications

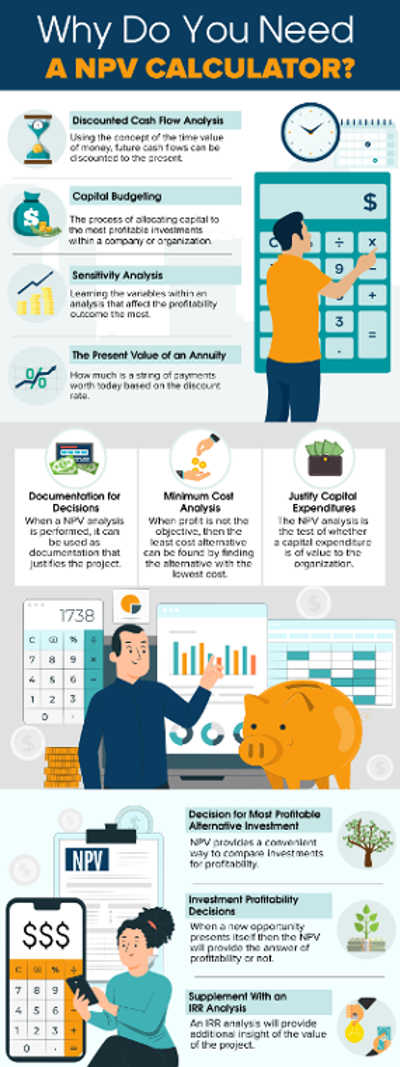

Listed below are a few possible applications you might use for NPV analysis:

- Discounted Cash Flow Analysis - Calculating the NPV will give one number for comparison between projects.

- Capital Budgeting – How to allocate a company’s limited capital between multiple projects or investments.

- Sensitivity Analysis - Different scenarios can be used to determine what the effects of changing different costs and revenues.

- Net Present Value of an Annuity – Finding the value of a future string of payments as of now.

- Documentation for Decisions – A record of a NPV analysis performed can serve as documentation for the justification of a project.

- Cost Plus Analysis – Determine the least cost alternative.

- Justify Capital Expenditures – A litmus test of whether a capital expenditure is of value to an organization.

- The decision for the Most Profitable Alternative Investment – NPV is a convenient way to compare investments.

- Financial Analysis - Determine how profitable a proposed investment will be. The higher the NPV is the more profitable an investment is likely to be.

- Optimization Analysis - Changing variables to maximize the present value.

Problems with Net Present Value Analysis

1. Comparing alternatives with unequal lives.

2. Estimating cash flows years into the future.

3. Inflation variability of over future years.

4. Black swan events that disrupt cash flows.

Summary

After utilizing the NPV calculator to determine the net present value of your projects, you can then make an informed decision regarding the most cost-effective project for your particular situation.

Q: What is an NPV financial calculator and how does it work?

A: An NPV (Net Present Value) financial calculator is a tool used to evaluate the financial viability of a proposed investment or project. It helps to determine the value of the investment by taking into account the expected future cash flows and the cost of the investment, both of which are discounted back to their present value using a specific discount rate. The NPV calc provides an estimate of the profitability of an investment, with positive NPV indicating that the investment is expected to generate more cash inflows than outflows, and vice versa. NPV financial calculators are often referred to as project NPV calculators.