NPV Definition

by Ahmed Vahed

(Oakville, ON, Canada)

What is the significance of NPV?

Answer

I guess that you are asking what the NPV definition is.

If you have a string of cash flows that extend over a number of years, it is hard to decide what the value of those cash flows are. NPV is an attempt to get a measure of the value of those cash flows boiled down into one number. So we first decide on a discount rate. That discount rate should be the minimum rate of return that you would be willing to accept on your money. So then you reverse compound each of your cash flows to the present. So if you have a cash flow of $1000 that will occur 2 years into the future and your discount rate is 8% then the present value of that cash flow would be $1000/((1.08)x(1.08))=$857.34. So if you have a cash flow at 4 years in the future you would divide by 1.08, 4 times. You get NPV or the Net Present Value when you take all the present values and net them together.

That is the NPV definition. If you want to know more please go to: Calculate NPV ... and Calculating Net Present Value ....

Discount Rate for a Net Present Value Project

by Andy

(Framingham, MA, USA)

I would like to calculate a present value of a stream of earnings using the following criteria:

* Discount period is 25 year period;

* Earnings are fixed in 5 year increments;

* Earning also every 5 years (10% increase).

Issue:

What is an appropriate Discount Rate?

* Federal Risk Free Rate;

* Present Borrowing Rate experienced by the Company;

* Compound annual growth rate for the past 25 years;

* Some Other Factor?

Please advise.

Comments for Discount Rate for a Net Present Value Project

|

||

|

||

Net Present Value

by Anonymous

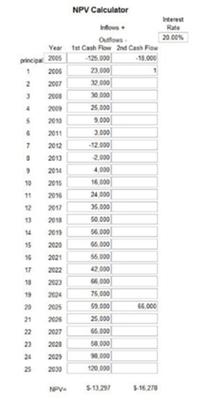

If I had $18,000 to invest in a project and the life of the project was 20 years, the single cash inflow at the end of 20 years is $66,000 and the company's discount rate is 20%, how do I find out what the net present value would be?

Answer

The illustration shows how you would use the NPV Calculator for the calculation. The discount rate of 20% over 20 years does not bring much back to present value. A little experiment shows that it would take $690,100 in year 20 (without other cash flows) to obtain a positive net present value.

A prudent person would reject this investment.